New Delhi, Feb 1: On Saturday, Finance Minister Nirmala Sitharaman announced the elimination of import duties on 12 essential minerals, including lithium-ion battery scrap, cobalt products, LED, zinc, and 36 drugs for cancer and rare diseases.

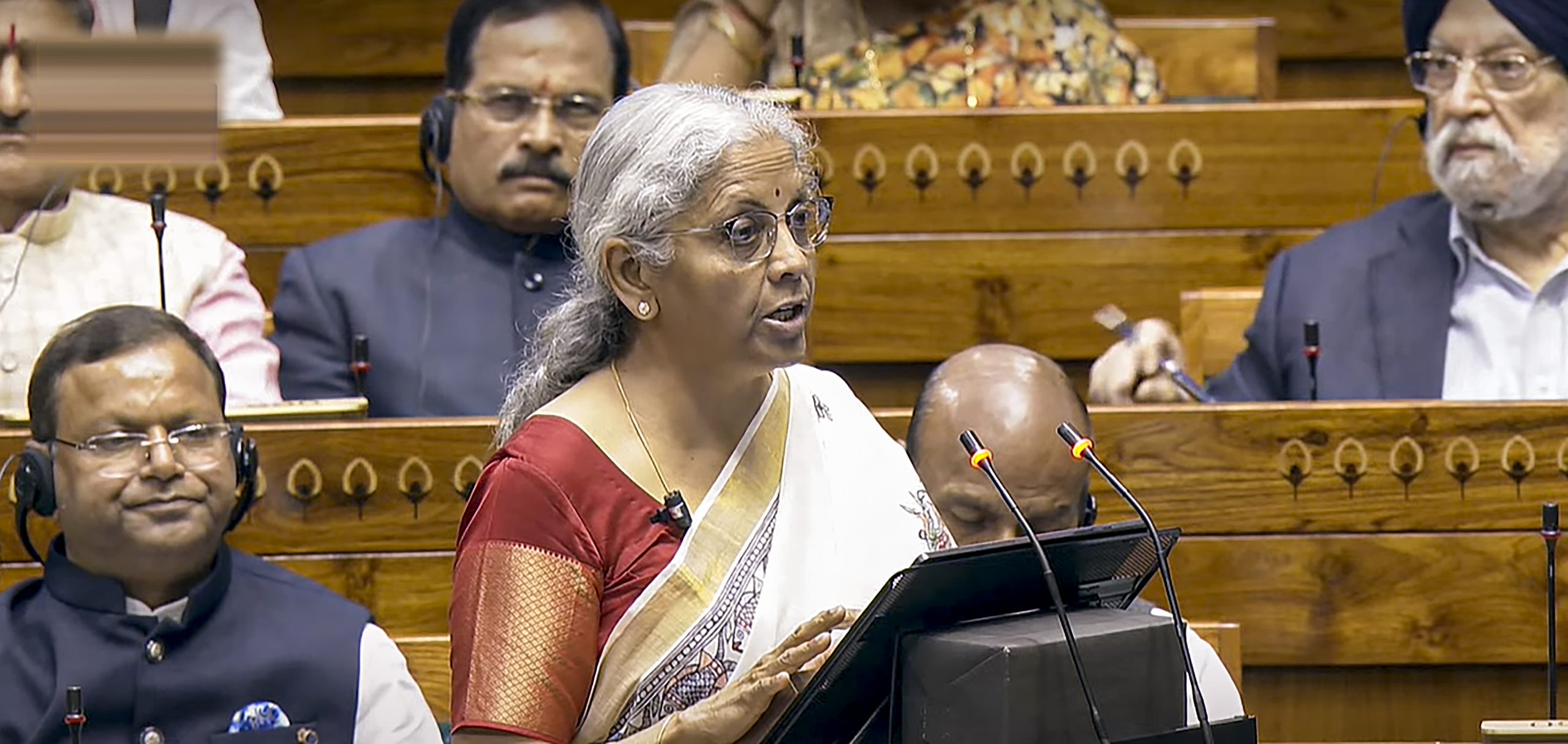

Delivering her eighth consecutive budget, Sitharaman also suggested limiting the imposition of cess or surcharges to just one instance.

Additionally, she proposed an exemption from the social welfare surcharge on 82 tariff lines currently subject to a cess.

“I propose to completely waive customs duties on 25 critical minerals and reduce Basic Customs Duty (BCD) on two of them. This initiative will significantly boost the processing and refining of these minerals and ensure their availability for key sectors,” she stated during her budget speech.

The minister also suggested including an additional 35 capital goods for EV battery manufacturing and 28 for mobile phone battery production to enhance the manufacturing of lithium-ion batteries for both sectors.

“I now propose to fully exempt Cobalt power and waste, along with lithium-ion battery scrap, lead, zinc, and an additional 12 critical minerals. This will secure the availability for manufacturing in India and generate more employment opportunities for our youth.”

Acknowledging the lengthy gestation period of shipbuilding, she recommended extending the BCD exemption on raw materials, components, consumables, or parts for ship manufacturing for another decade. The same exemption will apply to shipbreaking to enhance its competitiveness.

In alignment with the Make in India initiative and to correct the inverted duty structure, Sitharaman proposed increasing BCD on interactive flat panel displays from 10% to 20%, while reducing it to 5% for open cells and other components.

“To provide relief to patients, particularly those battling cancer, rare diseases, and other severe chronic conditions, I propose adding 36 life-saving medications to the list of those fully exempt from basic customs duty.” She also proposed to add six life-saving drugs that would be subject to a concessional customs duty of 5%. This full exemption and concessional rate will also be applicable to bulk drugs for the manufacture of these medicines.

Furthermore, she recommended a complete exemption of BCD on wet blue leather to facilitate imports for domestic value addition and job creation. (PTI)

Leave a Reply