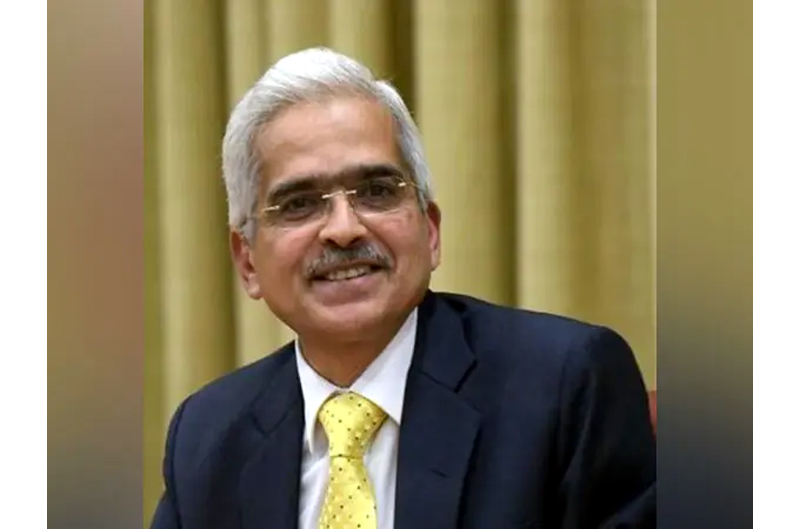

NEW DELHI, Dec 6: Net Foreign Direct Investment (FDI) inflows have dropped by 8.6% in the first half of the current financial year, totaling USD 3.6 billion compared to USD 3.9 billion during the same period last year, as reported by RBI Governor Shaktikanta Das on Friday.

Despite a 25.6% increase in gross foreign direct investment inflows, which rose to USD 42.1 billion from USD 33.5 billion year on year for April-September 2024-25, Das noted that net FDI has been affected by higher repatriations and increased outward FDI during this time.

Moreover, foreign portfolio investment (FPI) inflows into Emerging Market Economies (EMEs) have generally decreased in October 2024. So far in the 2024-25 fiscal year (up to December 4), net FPI inflows into India reached USD 9.3 billion, mainly driven by the debt segment. Meanwhile, external commercial borrowings and non-resident deposits recorded higher net inflows than last year.

In October 2024, net portfolio inflows into EMEs amounted to USD 1.9 billion, a significant decline from USD 33.9 billion and USD 56.4 billion in August and September, respectively. The debt segment saw net inflows of USD 27.4 billion in October, contrasted by net outflows of USD 25.5 billion in the equity segment amid rising geopolitical tensions, increased policy uncertainty, and portfolio rebalancing, Das explained while announcing the Credit Policy.

He emphasized, however, that India’s external sector remains robust, as reflected in several key indicators, with consistent strong performance.

India’s Current Account Deficit (CAD) to GDP ratio was 0.7% in 2023-24, down from 2.0% in 2022-23, and stood at 1.1% in Q1 of 2024-25 compared to 1.0% in Q1 of 2023-24. Additionally, the country’s external debt to GDP ratio slightly decreased to 18.8% at the end of June 2024 from 18.9% at the end of March 2024.

As of November 22, 2024, the import cover of reserves is approximately 11 months, and the net International Investment Position (IIP) remained stable at 10.3% of GDP at the end of June 2024, he noted.

To enhance capital inflows, it has been decided to raise the interest rate ceilings on FCNR(B) deposits.

Effective today, banks can offer new FCNR(B) deposits with a maturity of 1 year to less than 3 years at rates not exceeding the ceiling of overnight Alternative Reference Rate (ARR) plus 400 basis points, up from the current 250 basis points. Similarly, for deposits with a maturity of 3 to 5 years, the ceiling has been raised to overnight ARR plus 500 basis points, up from 350 basis points. This adjustment will remain in effect until March 31, 2025, the Governor stated.

(UNI)

Leave a Reply