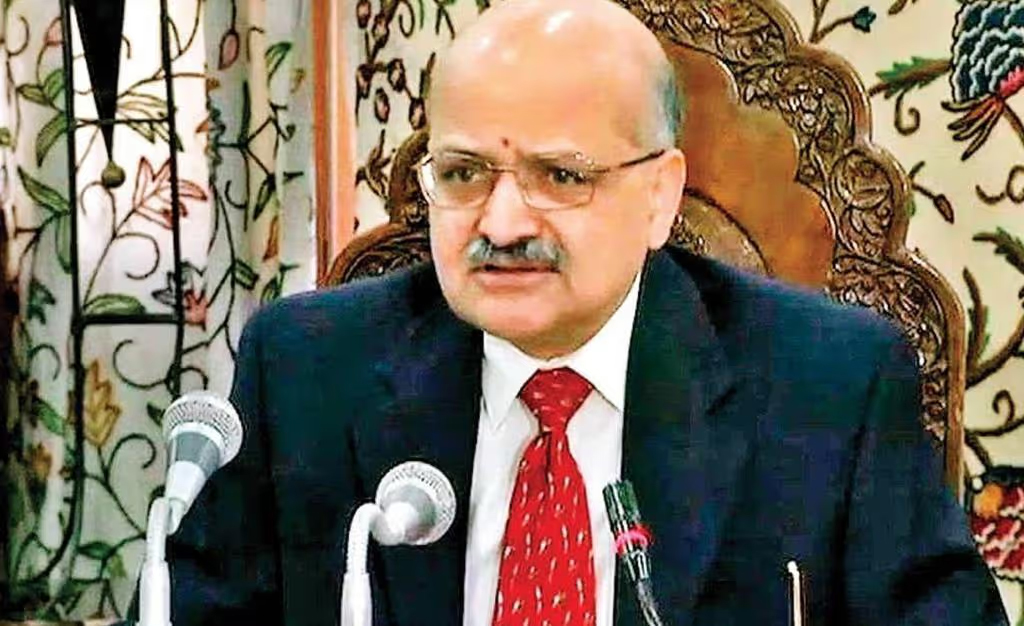

NEW DELHI, Dec 4: BVR Subrahmanyam, CEO of NITI Aayog, stated on Wednesday that the high tariffs pledged by US President-elect Donald Trump on three trading partners, including China, could create significant export opportunities for India. He urged domestic industries to prepare to capitalize on these changes.

Trump recently announced plans for a 25% tariff on imports from Mexico and Canada, as well as an additional 10% on Chinese goods.

“Everything that Trump has announced presents opportunities for India. We are positioned at first slip, and the ball is heading our way. It’s up to us to either catch it or let it slip away… and I believe we will see some actions in the coming months,” Subrahmanyam told reporters.

He noted that there would be substantial disruptions in US trade as a result, leading to substantial opportunities for India.

“If we adequately prepare, it could trigger a massive boom, as there will be a diversion of trade,” he added.

The United States is India’s largest trading partner, with India’s exports reaching USD 77.51 billion and imports totaling USD 42.2 billion in the previous fiscal year. Moreover, the US contributes to 70% of India’s IT export revenues.

“Our relationship with the US is rich and comprehensive. It is not solely based on trade; there are many other facets. The two countries share a profound connection that will be considered in these matters,” he explained.

These comments become particularly relevant as Trump referred to India as an “abuser” of import tariffs during his election campaign, echoing his earlier characterization of India as the “Tariff King” in October 2020.

He also cautioned BRICS nations against any attempts to supplant the US dollar and sought assurances from the nine-member group, which includes India, Russia, China, and Brazil, among others.

Additionally, NITI Aayog introduced a quarterly report on India’s trade.

Subrahmanyam emphasized the need for active promotion of trade to transition India into a developed nation.

Suman Bery, Vice Chairperson of NITI Aayog, remarked that attention should not be overly fixated on trade deficits as the economy benefits more from imports.

“Given our floating exchange rate, we will inherently have a trade deficit, and since we aim to invest, we will also structurally encounter a current account deficit… these are not necessarily negatives,” Bery stated, adding that “we must tread carefully to avoid restricting imports to the extent that it fosters local monopolies.”

He concluded that trade encompasses both exports and imports. (PTI)

Leave a Reply